This page contains affiliate links. Please read our disclosure for more info.

SafetyWing is the world’s first travel medical insurance developed specifically for nomads, by nomads. They cover people from all over the world.

Although it’s aimed at digital nomads and remote workers, it’s also a useful plan for anyone travelling long term, especially if you’re unsure how long you’ll be travelling for.

SafetyWing has several advantages over other travel insurance— you can purchase a policy when you are already abroad (with a few exceptions), pay every 28 days, and they cover COVID–19.

This detailed SafetyWing insurance review focuses on their Nomad Insurance Essential, the most affordable plan, which we used. I explore the pros and cons, what exactly is covered, and how much it costs.

I also compare it to SafetyWing’s Nomad Insurance Complete plan, which is more comprehensive global health insurance, as well as to other long term travel insurance policies, World Nomads, True Traveller, and Heymondo (all of which we’ve used before).

Contents

- Does SafetyWing Cover COVID–19?

- What Makes SafetyWing Different from Other Travel Insurance?

- SafetyWing Coverage

- How Much Is SafetyWing Nomad Insurance Essential?

- Signing Up For SafetyWing Insurance Essential

- Making a Claim with SafetyWing

- Downsides of SafetyWing Insurance Essential

- SafetyWing Nomad Insurance Essential vs Nomad Insurance Complete

- SafetyWing vs True Traveller

- SafetyWing vs Heymondo

- SafetyWing vs World Nomads

- Is SafetyWing Worth It?

- Sign Up for SafetyWing

- Other Travel Insurance Tips

This post was created in partnership with SafetyWing, but we chose to purchase insurance with them and genuinely think they are one of the best options for long term travellers.

Does SafetyWing Cover COVID–19?

Yes, SafetyWing does cover coronavirus (COVID–19).

SafetyWing says:

“Medical treatment of COVID-19 is covered on the same terms as any other disease. Testing for COVID-19 will only be covered if deemed medically necessary by a physician. The antibody test is not covered.”

SafetyWing also covers unexpected quarantine caused by COVID-19 outside your home country ($50 a day for up to 10 days) with the limitation of being once within a 364-day period.

What Makes SafetyWing Different from Other Travel Insurance?

These features stand SafetyWing Nomad Insurance Essential apart from typical travel insurance policies.

- Designed by nomads for nomads – They understand our needs and are continually adapting the product to better meet them.

- Subscription model – You don’t have to pay for a whole year upfront. Instead, you are charged automatically every four weeks. This is especially useful if, like us, you don’t know how long you’ll be outside your home country. You can cancel anytime.

- You can buy while travelling – This is rare as most travel insurance companies require you to be in your home country at the time of purchase. It’s ideal if you forget to buy insurance or your policy expires and you need to renew. SafetyWing is one of the best options for travel insurance when already abroad especially as cover is instant (some only start 2-3 days after purchase). Unfortunately, due to local regulations, you can not purchase cover while in Australia, Canada, or the US states, Maryland, New York, and Washington. For those destinations, buy before you arrive.

- No limit on duration of travel – If you are travelling for over a decade, like us, it’s no problem. After 364 days you’ll need to renew your policy, but this is easy.

- Travel with a one-way ticket – Unlike most insurance companies, SafetyWing covers you if you don’t know when you’ll be returning to your home country (as we never do) and don’t have a return ticket.

- Some coverage in your home country – Unusually, SafetyWing provides limited coverage when you return home. After being abroad for 90 days (or if you purchase 90 days of cover and go abroad during that period), you are eligible for home country coverage for 30 days (15 days in the US).

- Covers adventure activities – You don’t need to pay a premium for high risk activities as many are included as standard including horse riding, scuba diving, snowboarding, and bungee jumping. See below.

- Covers riding a motorbike or scooter – For many digital nomads, especially in SE Asia, getting around by scooter is common. But most companies don’t provide coverage, so it’s fantastic that SafetyWing does.

- No need to choose all destinations – We never know where we’re going to visit over the next year, so it’s helpful that SafetyWing provides worldwide coverage. You just have to choose your first destination and whether to include the US or not.

- Clear pricing structure – There’s no need for complicated quotes or choosing between multiple tiers, and there are no hidden costs. Pricing is based only on your age and whether you include the US.

- Free coverage for kids – Up to two children under 10 per family (one per adult) can be included for free.

- Focus on medical coverage – SafetyWing keeps costs low by focusing on the essentials for nomads, mostly emergency medical coverage, rather than including cancellation and other cover we’re less likely to need.

SafetyWing Coverage

Who Will SafetyWing Insure?

You are eligible for SafetyWing Nomad Insurance Essential as long as you are:

- Not a Cuban citizen.

- Between 15 days and 69 years old.

- Not physically present at the time of purchase in Australia, Canada, or the US states: Maryland, New York, and Washington.

- Intending to travel outside of your home country. (For the US, you need the US add-on, which is not available for US citizens).

- Not traveling to Iran, Cuba, North Korea, Russia, Belarus, Syria, and select regions of Ukraine: Luhansk, Donetsk, Crimea.

Countries Covered

You can be covered anywhere outside your home country except:

- Cuba, Iran, North Korea, Syria, Russia, and Belarus.

- USA (unless you have the US add-on).

- Select regions of Ukraine: Luhansk, Donetsk, Crimea.

Unlike other travel insurance, you don’t need to declare in advance all the countries you’ll be travelling to, except for your first destination.

You also need to decide whether to include the US or not, as understandably, this increases the price significantly.

They also don’t cover kidnapping or express kidnapping that begins in Afghanistan, Central African Republic, Democratic Republic of the Congo, Iraq, Libya, Mali, Niger, Nigeria, North Korea, Pakistan,

Somalia, Sudan, South Sudan, Syria, Venezuela, Yemen, or any country for which they are prohibited from transaction due to sanctions by the United States Department of the Treasury’s Office of Foreign Assets Control (OFAC).

Activities Covered

SafetyWing’s Nomad Insurance Essential policy covers many sports and activities as standard, but it’s best to reach out to customer care to check if a particular activity is covered.

You can also check the full list of excluded activities in the description of coverage (note that US residents have different policy terms).

Some of the adventure travel activities they cover include:

- Bungee jumping

- Camel riding

- Canyoning

- Cycling under 4,500 meters

- Hiking up to 4,500 meters

- Horse riding

- Hot air ballooning as a passenger

- Kayaking

- Motorbiking (excluding motorised dirt bikes and racing)

- Sailing

- Skiing (not off-piste)

- Snorkelling

- Snowboarding (not off-piste)

- Surfing

- Waterskiing

- Windsurfing

- Ziplining

- Zorbing

These are some notable exclusions, but you can now purchase an add-on to include them (not available to US residents):

- Cave diving

- Hand gliding

- Kite surfing

- Martial arts

- Luge

- Mountaineering at elevations of 4,500 – 6000 meters

- Parachuting

- Parasailing

- Scuba diving accompanied by a certified instructor

- Skydiving

- Snowmobile

- Spelunking

- Whitewater Rafting

Unusually, they do cover moped or scooter accidents as long as you are licensed for the area where you are driving and wear a helmet. Racing and driving while intoxicated are excluded.

It’s also notable that they cover skiing and snowboarding—winter sports usually cost extra with other travel insurance companies.

They do not cover organised athletics or professional sports or activities. And the sport or activity cannot be the main purpose of your trip.

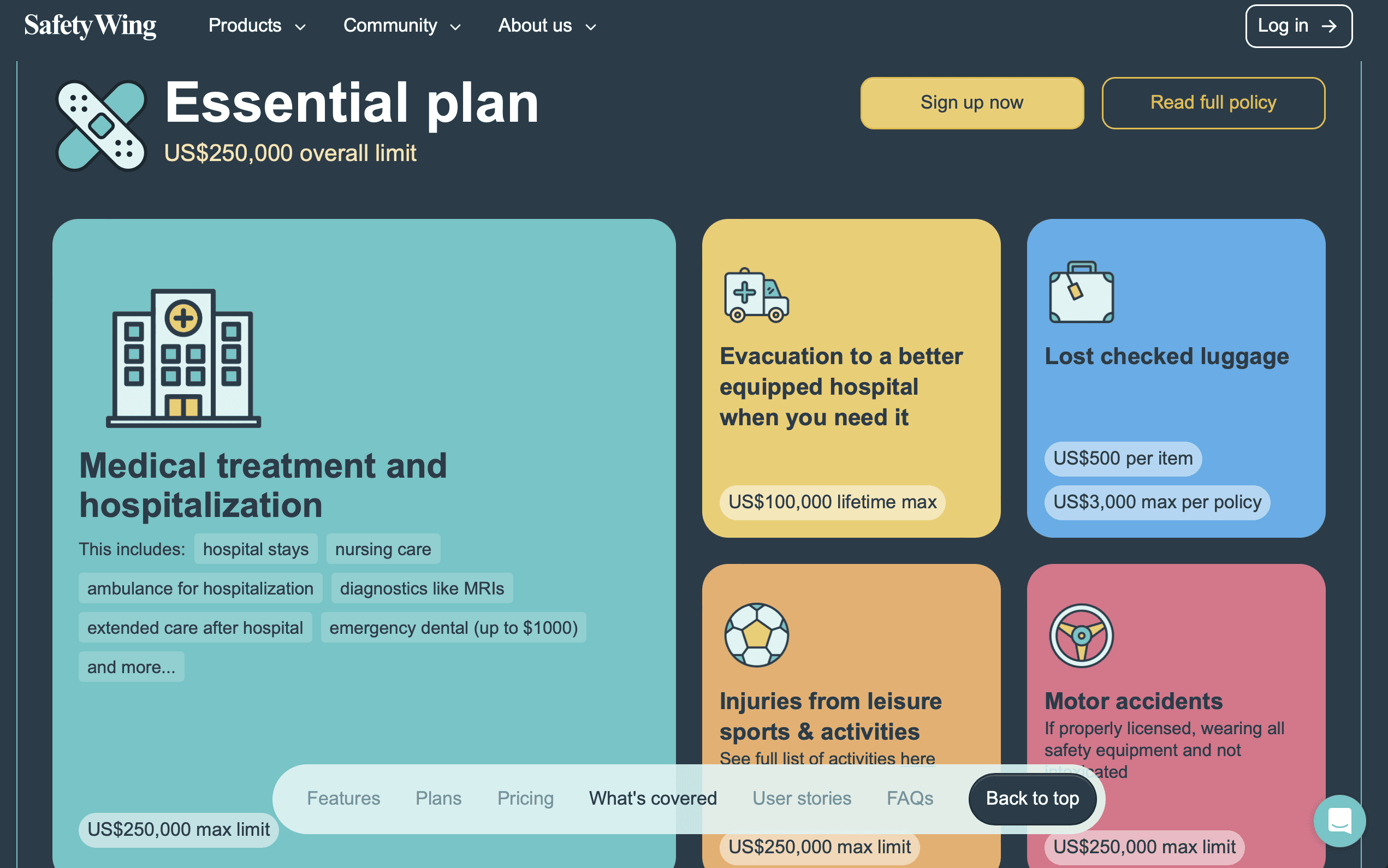

Maximum Payout and Deductible

SafetyWing’s maximum payout is US $250,000 ($100,000 for ages 65 – 69 years).

In 2024, they changed their deductible or excess (the amount you have to contribute if you make a claim) from $250 to $0. So you should be able to claim the full amount back.

Note that US residents still have a deductible of $250.

Medical

The main reason to purchase SafetyWing Nomad Insurance Essential is to be covered for emergency medical expenses in case you have an unexpected illness or injury.

Eligible expenses could include doctor and hospital fees, ambulances, and prescription drugs.

SafetyWing travel insurance also covers emergency dental treatment necessary to resolve acute onset of pain (if treatment is received within 72 hours)—they will pay out up to $1000 with no deductible.

They provide coverage for emergency medical evacuation (if deemed medically necessary by the attending physician) up to $100,000 lifetime maximum ($25,000 for acute onset of a pre-existing condition), with no deductible.

Like with all travel insurance, you are not covered for routine checkups, preventative care, and cancer treatment.

Unfortunately, pre-existing conditions are not included either, although there’s limited coverage for acute onset of pre-existing conditions (as long as they are not chronic or congenital conditions).

If you’d prefer more comprehensive health insurance while travelling, SafetyWing’s Nomad Insurance Complete plan offers global health insurance to cover your medical needs worldwide, including in your home country.

See below for more details about Nomad Insurance Complete.

Baggage

SafetyWing insurance doesn’t cover stolen baggage or electronics.

This doesn’t bother us as our clothes aren’t very expensive and the limits for electronics offered by other travel insurance policies are always too low to cover any of our devices. We make sure we have enough savings to replace our gear if necessary.

They do cover lost checked luggage up to $3,000 per certificate period and $500 per item with no deductible.

Other

Other travel insurance coverage provided by SafetyWing includes:

- Trip interruption – Up to $5,000. This covers a flight back home if you have to end your trip due to the death of a close family member, destruction of your principal residence (more than 40%, caused by fire or weather), or after an emergency medical evacuation.

- Travel delay – Up to $100 a day (maximum 2 days) after a 12-hour delay period requiring an unplanned overnight stay.

- Natural disaster – Covers a new place to stay up to $100 a day for 5 days.

- Political evacuation – Up to $10,000 lifetime maximum for transport to a safe country if the US Department of State has issued a level 3 or level 4 travel advisory after your arrival in the destination country. You must contact them within 10 days of the advisory being issued.

- Personal liability – Up to $25,000. Car rentals are excluded. See pages 27 and 28 of the description of coverage for more details.

- Accidental death & dismemberment – $12,500 to $25,000 ($2500-5000 for under 18s).

- Bedside visit – Up to $1500 to cover transport for one relative to visit you if you are in hospital intensive care with a life threatening injury or illness.

- Emergency reunion – Up to $50,000 (maximum 15 days) for transport, lodging and meals for one relative to visit you after an emergency medical evacuation.

None of the items above are subject to a deductible.

How Much Is SafetyWing Nomad Insurance Essential?

SafetyWing has a clear and simple pricing structure. The main things that affect the price are your age and whether you want to include the US.

Since 2023, non US-residents can now include add-ons for adventure sports and electronics theft ($10 extra per 28 days).

The standard policy costs a flat rate of US $56.28 which is automatically charged every 4 weeks until you cancel. Travel to the US costs extra.

Unfortunately, Nomad Insurance Essential gets significantly more expensive the older you get. For over 50s, especially those travelling to the US, I recommend checking out Heymondo Insurance instead.

Here is the cost per age group charged every 4 weeks (prices in USD).

| Age | Excluding US | Including US |

|---|---|---|

| 10 – 39 years | $56.28 | $104.44 |

| 40 – 49 years | $92.40 | $171.92 |

| 50 – 59 years | $145.04 | $282.80 |

| 60 – 69 years | $196.84 | $386.12 |

SafetyWing does not cover those aged 70 and over.

You will automatically be charged a recurring payment 3 days before every 28 day period until you cancel or until 364 days have passed, when you need to renew.

You can also choose specific dates for your trip (from 5 days to 364 days) and pay a one-off fee, which might be a good option if you want to travel for less than 28 days or prefer to pay upfront for a longer trip.

Signing Up For SafetyWing Insurance Essential

Signing up for SafetyWing travel insurance is easy.

First, create an account on the SafetyWing website by choosing an email address and password or logging in using Facebook. Then enter some details including your home country, date of birth, and address.

To activate your insurance, choose your start date and whether you will be travelling to the US or not.

You can also add family members or friends to your plan (as long as they have the same home country and are not aged 65-69).

You can pay by credit or debit card and you’ll be charged for every 4 weeks unless you select specific travel dates and pay upfront.

It’s easy to cancel at any time with one click and you’ll still be insured until the last day you’ve paid for.

If you go home earlier than expected and you want a refund for the unused days, you can reach out to customer care and they will issue a refund.

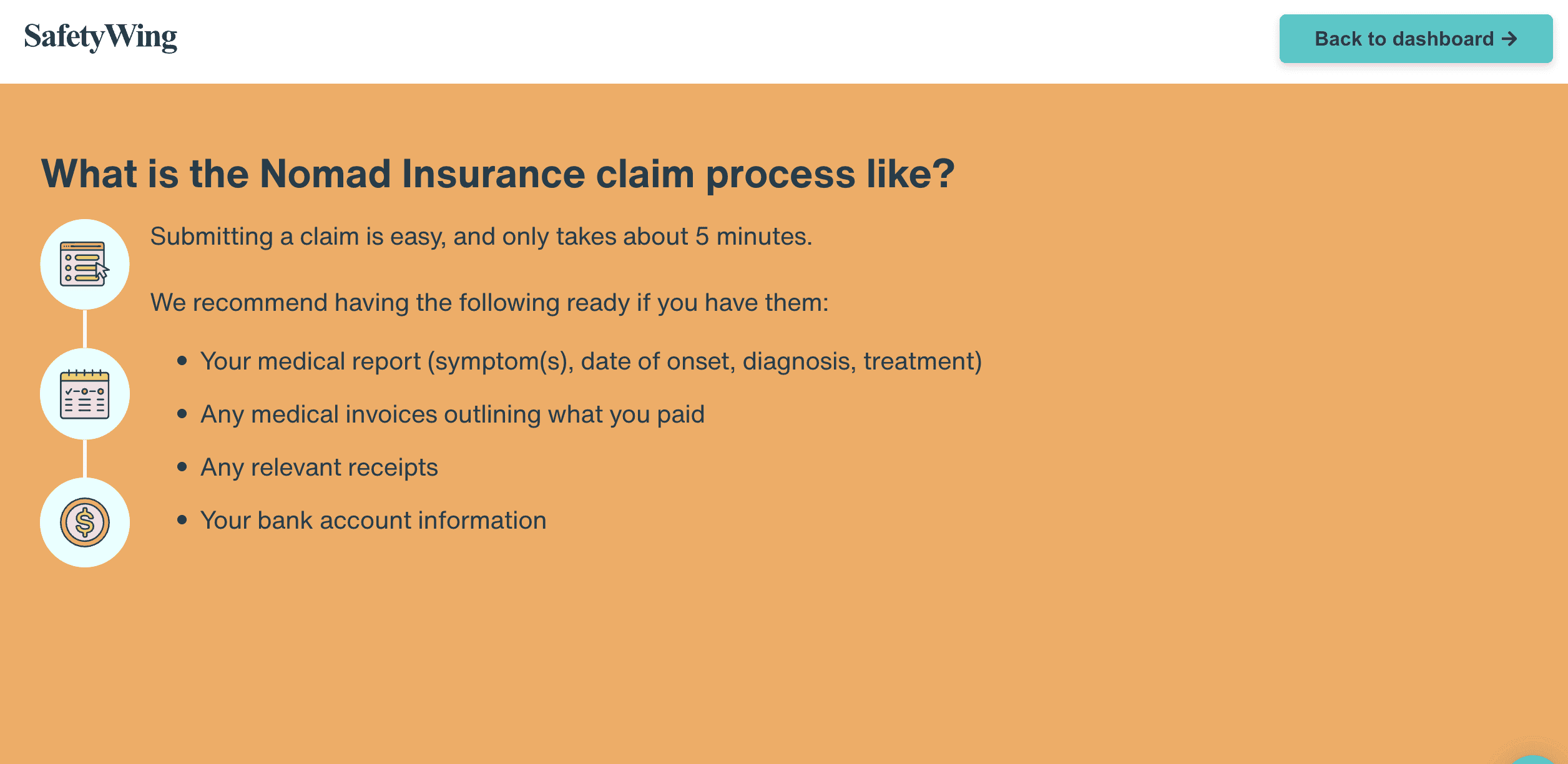

Making a Claim with SafetyWing

SafetyWing’s policy is administered by Tokio Marine, one of the largest insurance companies in the world.

We haven’t needed to make a claim on our SafetyWing insurance yet, but the process seems fairly simple.

On the SafetyWing website click on “Make a Claim” in the dropdown menu under My Profile and it will walk you through the process.

First, fill out the claims form (this can be done digitally) and then upload it with photos of receipts and other necessary documentation to Tokio Marine’s online portal.

All claims must be filed within 60 days of the end of your insurance.

Your claim should take less than 45 days to be processed and if approved, you will receive the money into your bank account by a wire transfer.

You are free to go to any doctor or hospital of your choice. Direct billing might be an option so you don’t have to pay yourself (typically this is only for inpatient care). For this it’s best to get assistance on choosing a hospital by calling the insurance helpline.

Otherwise, make sure to save receipts and relevant medical or police reports and test results.

Most reports of the claims process are really good. You can see reviews by people who have made claims on Trust Pilot.

Downsides of SafetyWing Insurance Essential

These are the areas where SafetyWing could be improved:

- Low maximum payout – The $250,000 max payout is much lower than the millions in coverage offered by other travel insurance. While this should be enough coverage in almost every case, if you suffer a very serious accident in the US and have to stay in hospital for an extended period, there’s a chance you could reach the maximum. SafetyWing says they have never had a claim that exceeded $250,000 and their goal is to make their policies affordable so that nomads don’t go without insurance entirely.

- No stolen baggage – Unless you pay for the electronics add-on, but this only covers electronics up to $1000 per item. If you need more coverage, check out Heymondo’s Premium plan for up to $2500 of cover.

- No pre-existing conditions – This is standard with travel insurance but it’s still a shame. Nomad Insurance Complete is your best option to cover existing conditions.

- No cancellation cover – This is something that most other travel insurance offers. Honestly, though, it’s not usually relevant to digital nomads as it only applies to trips being cancelled before you leave your home country.

- No coverage for some adventure activities for US residents – If Americans want to go whitewater rafting, parasailing or kite surfing, they won’t be covered. Non-US residents can now purchase an add-on for these.

- $250 deductible for US residents – The new zero deductible doesn’t yet apply for Americans.

- Much more expensive the older you get – Each time you move into a new decade your premium shoots up.

- Doesn’t cover ages 70+ – Unfortunately, this is common with long stay travel insurance.

- Doesn’t cover certain destinations (see the SafetyWing Coverage section above for exclusions).

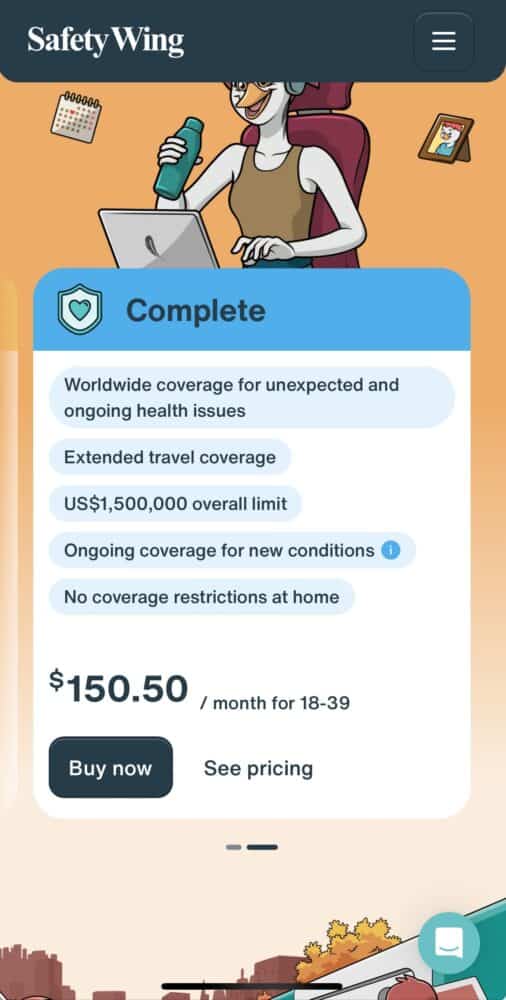

SafetyWing Nomad Insurance Essential vs Nomad Insurance Complete

SafetyWing’s Nomad Insurance Complete plan is global health insurance for nomads and remote workers.

If you want comprehensive health insurance while you travel the globe, this could be a good option.

Compared to Nomad Insurance Essential (reviewed above), it has the following advantages:

- Coverage provided in your home country (except for US residents and a few other countries).

- Covers cancer tests and treatment.

- Covers approved pre-existing conditions (some may be excluded).

- Claims are processed within 7 – 15 days.

- Or they pay medical providers directly for scheduled treatments (over $250).

- US $1.5 million maximum per policy year.

- Premium plan includes routine dental, vision, screenings, vaccines, and mental health (limits apply).

- Maternity care included in Premium plan.

- Wellness benefits such as acupuncture, chiropractic care, osteopath and dietician visits and more.

- No deductible.

- Covers up to age 74 (but is much more expensive for older age groups).

- Covers eligible medical expenses for adventure sports and activities (professional sports excluded).

The disadvantages of Nomad Insurance Complete compared to Nomad Insurance Essential are:

- You need to apply – You must provide medical history before your application is approved and not all applicants can be covered.

- Much higher cost – For individuals aged 18–39 years, it starts from $150.50 a month for the standard plan.

- 30 days of coverage in the US, Hong Kong and Singapore. Option to add up to 6 months of coverage in the US and 12 months in Hong Kong and Singapore.

- Minimum one year term – You can pay quarterly or yearly.

Nomad Insurance Complete is worth considering if you want comprehensive long term health insurance that will cover more than just emergencies.

It could be a good option if you have a pre-existing condition (and it is approved), think you’ll need more regular medical care including maternity, need health insurance in your home country, and/or want to cover against worst case scenarios like cancer.

SafetyWing have a handy side by side comparison on their website to help you decide which plan is better for your needs.

For us, it’s currently more cover than we need at a higher price than we’re willing to pay (especially as we’re in a higher price bracket in our 40s).

If we didn’t have free healthcare in the UK, or weren’t willing to return there for a serious illness (like cancer), we’d definitely consider it.

Get a quote and apply for Nomad Insurance Complete here.

SafetyWing vs True Traveller

We used True Traveller insurance for eight years and would be happy to again, but it’s only available for UK and EU residents.

We wanted to try insurance that’s accessible to more of our readers, which is why we tried SafetyWing last year.

Like SafetyWing, True Traveller offers travel insurance after departure and for those travelling without a return ticket, and they cover COVID–19.

They offer three policies: True Value (for under 40s with the most basic coverage), Traveller, and Traveller Plus.

Here are the advantages of True Traveller over SafetyWing:

- Much higher medical coverage at £10 million.

- Much higher personal liability cover from £1 million to £2 million.

- Cheaper if you pay upfront for a year – My quote for a 39 year old on a year-long trip worldwide excluding the US/Canada was the equivalent of £29/£38/£45 per 28 days. The price does increase if you add extra activities though.

- You can choose from four travel areas: Europe, Australia and New Zealand, Worldwide excluding US and Canada, and Worldwide.

- 92 activities covered as standard and you can add more at an additional cost.

- Option to include baggage cover and valuables at an extra cost, but again the valuables limit is so low (£450 to £750) that it’s not useful for us.

- You can extend your policy and get a 10% discount.

The disadvantages of True Traveller compared to SafetyWing are:

- Only covers UK and EU residents.

- More expensive for shorter trips – My quote for a 39 year old on a 28-day trip worldwide excluding the US/Canada was £92/112/131.

- The maximum age they can insure is 65.

- Winter sports coverage is only included at an additional cost.

- They don’t cover COVID–19.

- If you purchase after departure, the policy but will not be valid for 48 hours.

For UK residents 65 years old and under, True Traveller offers more comprehensive insurance than SafetyWing, and if you can pay in advance for a longer trip, it will likely be cheaper.

I recommend getting a quote from True Traveller, though, as the price will depend on your age, where you are travelling to, the length of trip, and what activities and extras you want to include.

True Traveller does lack the flexibility of SafetyWing’s subscription payment method and is much more expensive if you only want to insure yourself for a month or so at a time.

See our True Traveller insurance review for more details.

SafetyWing vs Heymondo

Heymondo offers a variety of comprehensive travel insurance policies including single trip, multi-trip, and long stay (over 90 days).

Their policies are available worldwide and cover COVID-19.

We used Heymondo for a 3-month trip to the US as it worked out cheaper and more comprehensive than SafetyWing (for us in our 40s).

Heymondo has these advantages over SafetyWing:

- Much higher medical coverage from €3.5 million to €10 million (up to $500,000 for US residents)

- Much higher personal liability cover up to €2 million.

- Cancellation cover is included.

- Highest electronics limit (with the Premium plan you can pay extra for up to €2500 cover).

- Rental car excess cover (with Premium plan)

- Cheaper for over 50s travelling to the US (and possibly over 40s).

- 24-hour chat with a doctor on their app

The downsides are:

- Much more expensive for under 50s. A 4-week trip worldwide for a US resident of any age costs $109 for their Top policy and $139 for Premium.

- Limited adventure sports included (no ski cover)

- If you purchase after departure, the policy but will not be valid for 72 hours.

- No online claims – To make a claim we had to call them and get them to email the claims forms.

While Heymondo does offer higher amounts of cover, it is much more expensive for under 50s not travelling to the US and doesn’t cover as many adventure activities.

Click here for a Heymondo insurance quote (with a 5% discount for Never Ending Voyage readers).

SafetyWing vs World Nomads

World Nomads is a well-known travel insurance company that’s popular with many nomads and long-term travellers. We used them ourselves for our round the world trip in 2008.

Like SafetyWing, they offer insurance when you are already abroad and travelling with a one-way ticket, and they cover most nationalities (currently excluding Europe).

It’s difficult to do a direct comparison as World Nomads has different policies depending on your home country, and there’s no clear pricing structure so you need to get a quote based on your nationality, age, countries you’ll be visiting, and length of trip.

They also offer two levels of coverage—Standard and Explorer—and a variety of add-ons.

It’s best to get your own quote, but I’ve based the World Nomads numbers below on a quote for a 39-year-old from California, USA and from the UK.

Compared to SafetyWing’s Nomad Insurance, World Nomads has these advantages:

- For some nationalities, much higher emergency medical coverage – In the UK it’s £5 million or £10 million vs SafetyWing’s $250,000 maximum payout. For US residents it’s a lower $100,000, though.

- Cancellation cover – Something SafetyWing doesn’t provide. Although this only covers you before you leave your home country so is of limited use to nomads.

- Stolen baggage cover – $1000/3000 of cover (or £1000/2000 in the UK). But the valuables limit is low. You can add additional high value items in some countries at an extra cost, but the maximum amount per item is £400 which won’t cover most laptops, phones or cameras.

- Rental car excess cover with Explorer plan in the UK or rental car damage in the US.

- Covers a wider range of adventure activities and in some countries, you can add specific activities you want to be covered.

The disadvantages of World Nomads compared to SafetyWing are:

- Much higher cost – My World Nomads quote for a US resident (all ages) for 28 days worldwide was $207 for Standard or $369 for Explorer for 28 days. Even paying upfront for a longer trip it worked out at $150 per 28 days. For UK residents up to 50, the same trip is £100/£125 for 28 days or it comes down to £42 per 28 days if you pay for a year upfront.

- You have to choose your trip length and pay upfront – This can be difficult if you don’t know how long you’ll be away.

- No COVID–19 cover for some nationalities – They do now provide COVID-19 cover if you are from the US, Canada, UK, Ireland and others, but not all countries are included. You won’t be covered if there are travel advisories for the country you are visiting.

- Lower medical coverage for US residents ($100,000).

- Doesn’t cover any time in your home country.

- No free coverage for children under 10.

- You have to choose specific countries or regions you’ll be visiting or select worldwide.

While World Nomads does offer a higher amount of coverage for those outside the US, it comes at a much higher price.

It also lacks the flexibility of SafetyWing’s subscription model.

Is SafetyWing Worth It?

Yes, SafetyWing travel medical insurance is ideal for digital nomads, remote workers, and long term travellers from most countries. It’s flexible, affordable, and easy to sign up for.

No one likes paying for travel insurance, but it’s important to have coverage in case anything goes wrong. Accidents and illnesses abroad do happen and without insurance, you could be left with a bill you can’t afford.

Sign Up for SafetyWing

I hope my SafetyWing review has helped you decide if it’s right for you.

You can get a quote for SafetyWing Nomad Insurance Essential here or fill in your details below.

Other Travel Insurance Tips

- How to Buy Travel Insurance After Departure

- TrueTraveller Insurance Review: The Best Long Term Insurance for UK and EU Residents

If you enjoyed this post, pin for later!

You might note that with Safety wing, adventure sports are now an add-on and US citizens are not able to purchase.

Thank you – I’ll update the post.

Very helpful post so thanks.

The only thing I would like to share is related to my very recent experience with HeyMondo and will only apply to very few, but still worthy of sharing so that fellow travellers don’t have a situation we just found ourselves in.

In April 2022 we purchased a policy with HeyMondo for a travel period due to start in November.

At the time of application we we already travelling outside of our USUAL RESIDENCE in Australia so selected the ALREADY ABROAD checkbox understanding that there was a 72-hour exclusion period which wasn’t really relevant as there were still months before our specific trip date.

When one of flights were cancelled I contacted HeyMondo to request a change of start date and was advised our policy was VOID because our start date was more than 72-hours after the date of application AND that our return date was NOT a return to our USUAL HOME RESIDENCE COUNTRY.

Coming from a legal background I queried this claim and they were unable to point where in their policy wording it was stated so that any reasonable English speaking person would interpret their meaning and they couldn’t.

To their credit, they did cancel the policy and refund us in full, however this clearly shows that HeyMondo may not be the best for Digital Nomads that want segments of travel covered and that do not have a confirmed return date to their USUAL RESIDENCE.

I’m likely going to SafetyWing for insurance now given what I have learned.

So for anyone reading, please be careful when selecting insurance, and if in doubt, email the insurer and request in writing a response to any questions you have so safeguard yourself so that you don’t get caught when it’s too late.

Thanks again for a great post.

Thanks for letting us know about this Anthony. I followed up with Heymondo about this and this is their response:

“At the moment, we aren’t able to identify this case (this client’s policy in particular) to review the communications we’ve had with him.

What he explains seems a bit strange, because we do cover travelers who don’t have a return ticket. In fact, we have a product specifically designed for that (Heymondo Long Stay). Also, with other policies, we can even insure travelers without a return ticket. This really isn’t an obstacle. It’s also not true that you can’t contract the policy with a 72-hour margin, since you can take out the policy up to a year in advance if you wish.”

I’m not sure what happened here as it does seem they cover people on one way tickets (and we’ve used them ourselves and bought a policy more than 72 hours in advance).

Thank you for the thorough review Erin. As usual, your detailed analysis is very helpful.

I’m glad it helped Susan!

Thank you so much Erin,

You’re tips & reviews of insurance whilst travelling has been so very helpful!

I’m a Kiwi in Milan & with my travel insurances running out, it’s been stressful to try & find cover, but your blog was clear / detailed & super easy to follow.

SafetyWing is a great temporary (or perhaps will need to be permanent!) option, the trouble I’m finding is getting any sort of travel cover for belongings / tech equipment / car & property accident cover etc…..it seems crazy but I cannot find any policy that covers this!

Thanks again & I hope you loved your time in NZ :)

Campbell

I’m glad SafetyWing will work for you. We’ve given up on finding cover for our electronics as there seem to be no good options for people travelling long term. I hope you find something that works for you.

And yes, we absolutely loved New Zealand – we miss it!

Thank you once again for saving us valuable time in our search for affordable traveling health care. As usual you are spot on in your recommendations. We have been following you guys for at least five years now, starting before we sold everything we owned and left for our new lives of traveling. We both have reached the “midlife” ages of 65 which puts in in different requirements for most everything such as, Insurance changes, social security options and physical activites. We are fountunate enough to have the finical means to protect ourselves without insurance (to a certain age) but, it is wise to have the added shield for the unknown cost. Enjoy and don’t let the old man in.

I’m glad the post helped, Stephen! It sounds like you are living an exciting life – enjoy!